Hey Hey Everyone!

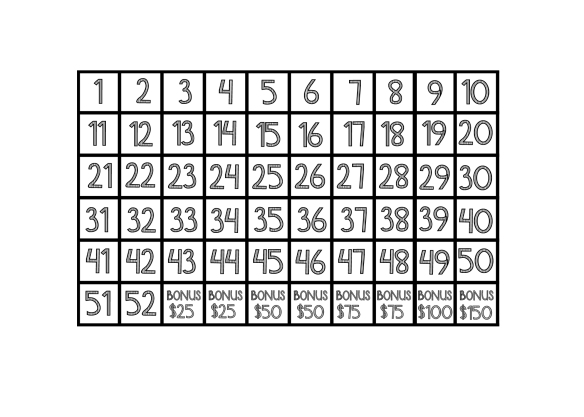

It’s been exactly a week since I last wrote about saving money with the bingo 52 week challenge. I have been having so much fun with the bingo one rather than the regular 52 week challenge. But really, who doesn’t like coloring? I think that’s the “fun” part about doing the bingo style challenge; you get to color it in! Yes, my inner child likes to come out from time to time.

A little off topic but aren’t my mom’s Valentine’s day decorations cute! I love this sign.

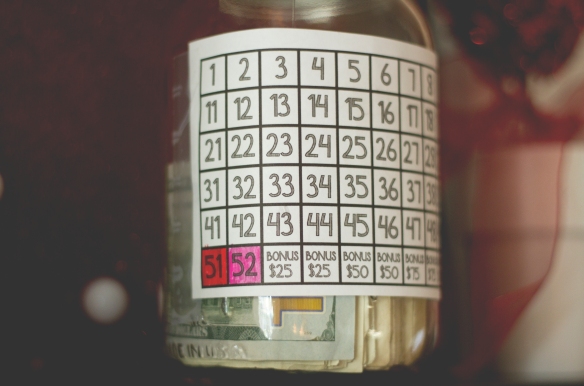

Back on track. So this week I have managed to mark off quite a few squares. If you remember last weeks jar, I didn’t have many marked off at all. [sad jar]

Yep, I had a whopping 3 squares marked off. This week I have managed to mark off:

1-10

&

11, 14, 20

That’s quite a bit! That’s $253 that I’ve saved since starting this year! Whew! This is going to be used toward getting a new motor for my car. [eeee, can’t wait!]

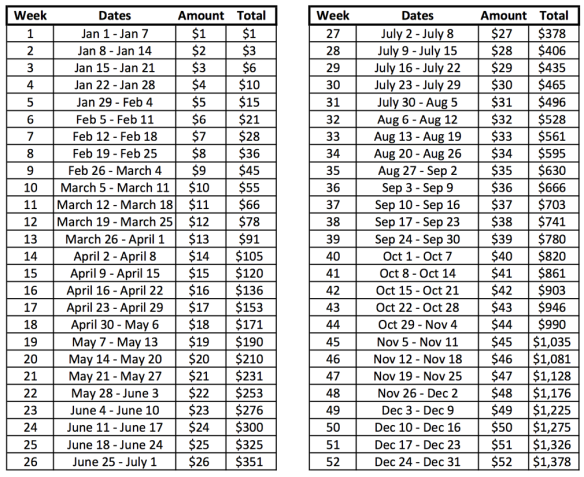

If you’re looking for an easy way to save money, then this is it! It’s also a great way to get kids started on the importance of saving money. Of course, it’s a little hard for a kid to come up with $50 at one time but you can always turn the bingo challenge into a penny challenge and have the child put in a penny for week 1, then 2 for the second week and so on.

I know from personal experience that I would have loved it had my parents taught me how to start saving money at a young age. I know when it’s my time to be a parent, I’ll teach my kids about saving money so they’ll have a good start on their future.

If you’re a little worried about starting the bingo challenge and you’re sitting there thinking, “Katie makes it look easy but I can’t spare a lot of money each week”. Well, you don’t have to do weekly, you can always put in as much money as you want whenever you want. That’s the joy about doing the bingo version versus the regular 52 week challenge. On that one you have deadlines to meet for each amount. I love the bingo style because there’s no time frame. You simply put in the amount you can spare whenever you can spare it. For me, I usually have a week or two out of the month that I actually have money so I’ll plan out how much I want to put in the jar because you know, once it goes in, that means no touchy touchy! I personally like to try to knock out the bigger amounts when I can but sometimes I only have $15 and that’s okay. You do what you can.

If you have any questions regarding the Bingo 52 week challenge, please leave a comment below and I will answer it promptly! If you’re interested in printing out my version of the bingo square, click here.

I hope you all enjoyed my post and as always, have a great rest of your week!

Now get to saving!

Xoxo Katie